Zoning in Real Estate: What It Is and Why It Matters to Investors

Zoning in Real Estate: What It Is and Why It Matters to Investors

Zoning is one of the most important—and most misunderstood—elements of real estate investing. While investors often focus on location, pricing, and projected returns, zoning quietly determines what can be built, how a property can be used, and whether a project is realistically achievable.For investors seeking to understand risk, timelines, and long-term value, zoning is not a technical detail. It is a foundational driver of real estate outcomes.

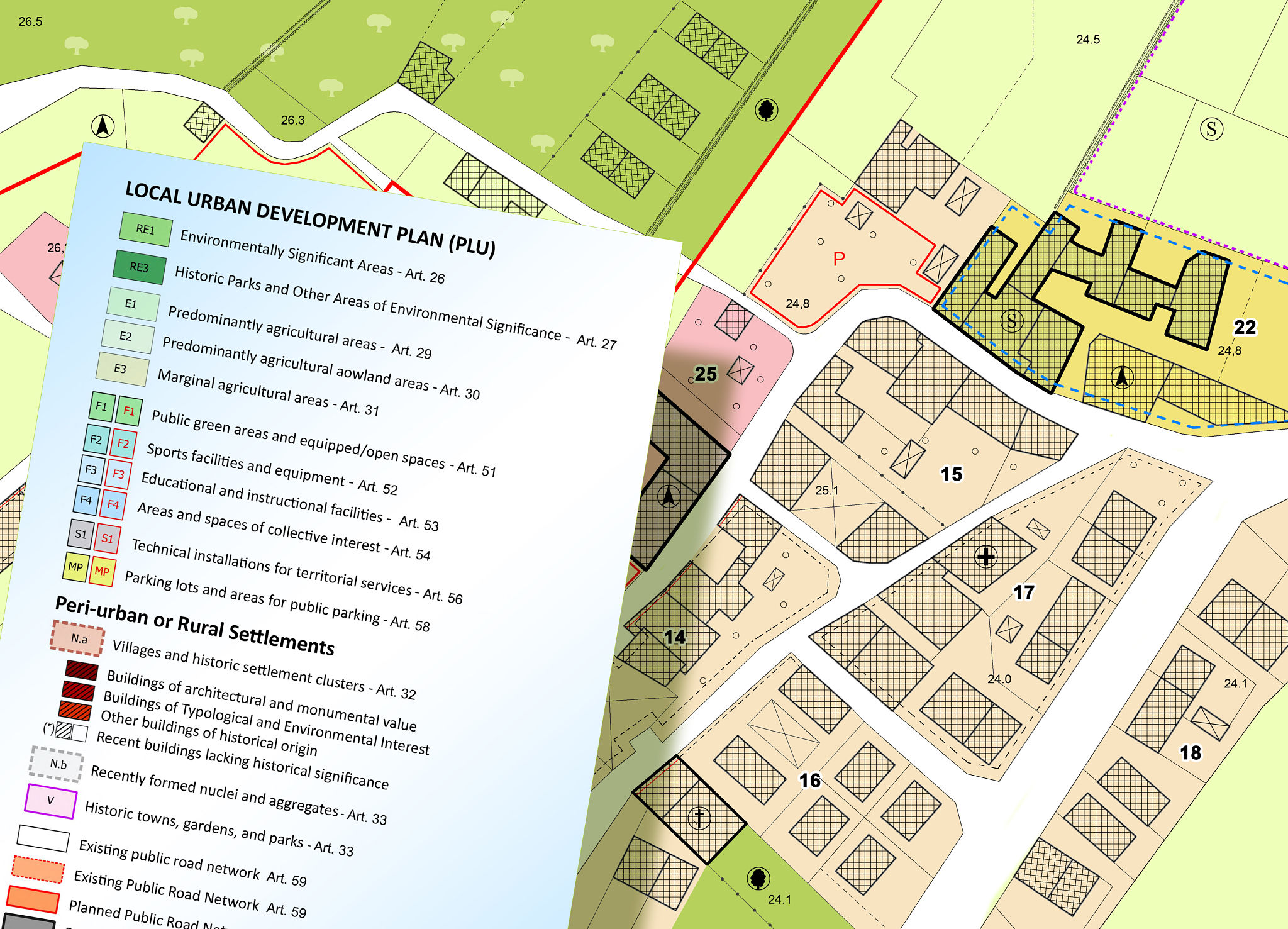

What Is Zoning in Real Estate?

Zoning refers to local laws and regulations that govern how land can be used and developed. Cities and municipalities divide land into zoning districts, each with specific rules around permitted uses, building height, density, unit count, parking requirements, and setbacks.In practical terms, zoning answers questions such as:

What type of property can be built on this land?

How many units are allowed?

How large or tall can the building be?

Are certain uses restricted or prohibited?

Zoning is established through city planning processes and reflects long-term goals related to growth, infrastructure, housing, and community impact.

Why Zoning Exists

Zoning exists to guide orderly development and balance competing interests within a city. It helps manage population density, traffic flow, public services, environmental impact, and neighborhood character.From an investor’s perspective, zoning creates predictability. It defines what is allowed today and signals how a city intends to evolve over time. While zoning can feel restrictive, it also creates structure and scarcity, which are key drivers of long-term real estate value.

Common Types of Zoning

Residential Zoning

Residential zoning governs single-family homes, multi-family apartments, and condominiums. Regulations typically control density, unit count, building height, and sometimes occupancy type.

Commercial Zoning

Commercial zoning applies to offices, retail, hotels, and certain mixed-use developments. These zones often allow higher density but impose use-specific requirements and parking standards.

Industrial Zoning

Industrial zoning covers manufacturing, warehouses, and logistics uses. These zones are usually separated from residential areas due to noise, traffic, or environmental considerations.

Mixed-Use Zoning

Mixed-use zoning allows a combination of residential and commercial uses within one property or district. These zones are common in urban cores and transit-oriented areas and often involve more complex approval processes.Understanding the specific zoning designation, not just the general category, is critical. Two properties with similar labels can have very different development potential.

Why Zoning Matters to Real Estate Investors

Zoning Determines What Is Legally Possible

At the most basic level, zoning determines whether an investment strategy is feasible. A property zoned for single-family use cannot support multi-unit or commercial development without additional approvals.No matter how attractive the price or location, zoning that does not align with the intended use creates immediate risk. This makes zoning one of the first and most important filters in real estate analysis.

Zoning Directly Impacts Risk, Timeline, and Cost

Projects that rely on rezoning, variances, or discretionary approvals face greater uncertainty. These processes can extend timelines, increase costs, and introduce political or community risk.For investors, zoning-related risk often shows up as:

Delayed project starts

Higher carrying and financing costs

Uncertain cash flow timing

Increased execution risk

Understanding zoning early helps investors evaluate whether projected returns properly compensate for these uncertainties.

Zoning Shapes Supply and Long-Term Value

In many high-demand markets, zoning limits how much new housing or commercial space can be built. These constraints restrict supply and can support long-term property values once projects are successfully completed.From an investment standpoint, restrictive zoning increases complexity—but it also creates barriers to entry that protect value over time. This is why zoning is a key driver of appreciation, not just a regulatory hurdle.

Zoning vs. Entitlements: Understanding the Difference

Zoning defines what is allowed by right under the law. Entitlements are the specific approvals required to build a particular project.A property may be properly zoned but still require design review, site plan approval, or conditional use permits. Each entitlement adds time, cost, and uncertainty, making experience and local knowledge essential.Many real estate projects succeed or fail at the entitlement stage, not because of market demand, but because of regulatory complexity.

Why Zoning Knowledge Separates Investors From Speculators

Zoning risk is often invisible in financial models. Optimistic assumptions about approvals and timelines can make projects appear more attractive on paper than they are in reality.Experienced investors evaluate zoning conservatively. They focus not only on what is technically allowed, but on what is realistically achievable given local politics, planning priorities, and historical precedent.This discipline is what separates long-term investors from short-term speculation.

Zoning in High-Barrier Markets

In markets with complex regulations and discretionary approvals, zoning becomes a competitive advantage rather than a simple constraint. Investors and operators with deep local knowledge are better positioned to navigate approvals responsibly and manage timelines realistically.These markets tend to reward patience, experience, and disciplined underwriting rather than speed or aggressive assumptions.

Why Zoning Matters to Moo Capital’s Investment Approach

At Moo Capital, zoning analysis is central to how we manage risk. We focus on understanding what is permitted today, what requires approval, and how regulatory timelines affect capital deployment.By grounding investment decisions in zoning realities rather than assumptions, we aim to reduce execution risk and align expectations over the full life of a project. This approach reflects how professional developers operate in practice, particularly in complex, supply-constrained markets.

Final Thoughts

Zoning is not just a regulatory detail—it is a foundation of real estate investing. It determines feasibility, shapes risk, and influences long-term value.For investors who want to understand real estate beyond surface-level metrics, zoning is essential knowledge. It defines not only what can be built, but how confidently an investment can be executed over time.This content is for educational purposes only and does not constitute legal, tax, or investment advice.